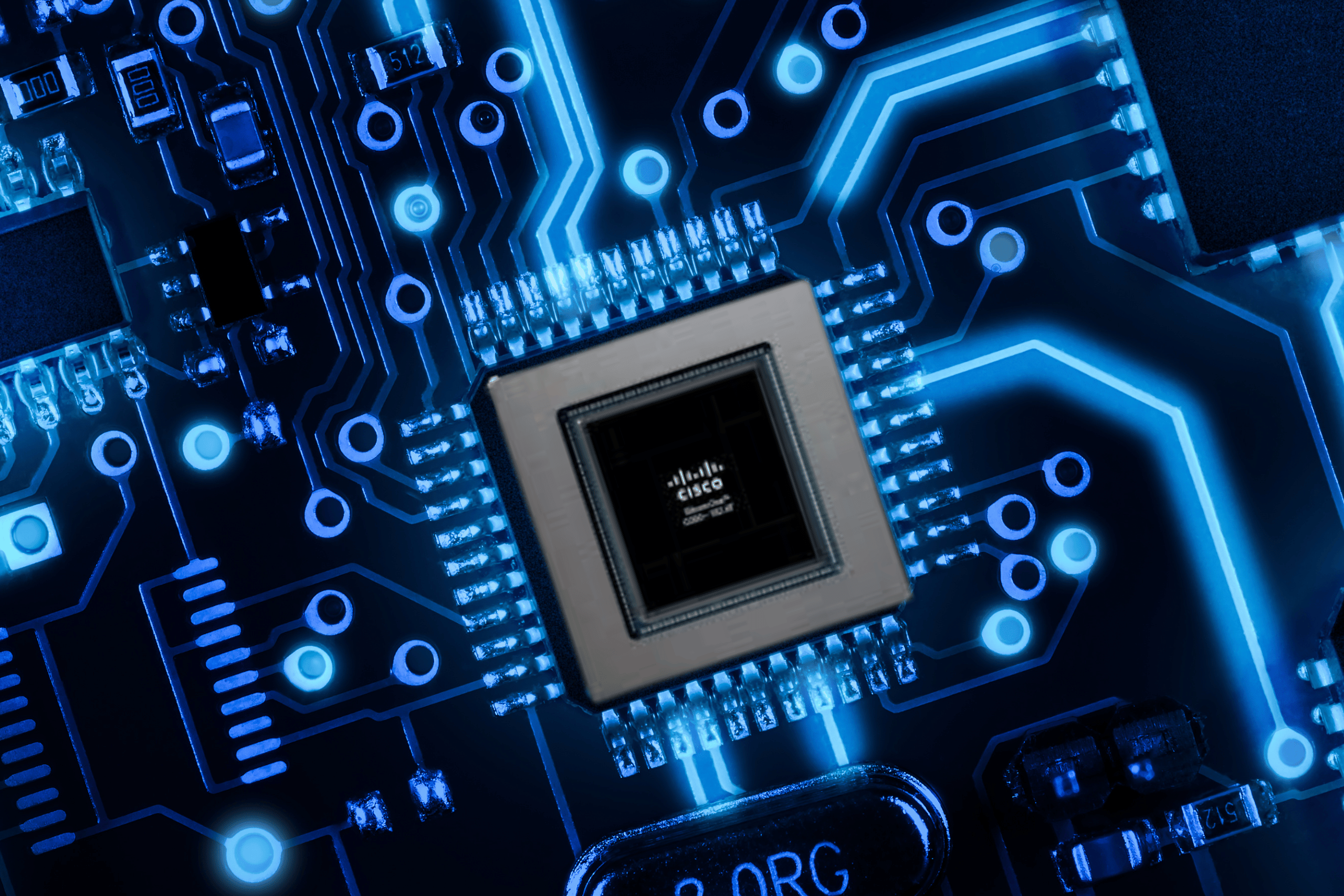

Cisco Systems has unveiled its most ambitious AI infrastructure play to date with the launch of the Cisco Silicon One G300 AI networking chip 2026 at Cisco Live EMEA in Amsterdam. This 102.4 terabits-per-second switching silicon positions Cisco to compete directly with Nvidia and Broadcom for a share of the $600 billion AI infrastructure spending boom transforming the global tech industry.

What is the Cisco Silicon One G300 AI Networking Chip?

The Cisco Silicon One G300 AI networking chip 2026 represents Cisco’s answer to the networking bottleneck that has emerged as AI models grow increasingly large and complex. Announced on February 10, 2026, this advanced switching chip will power new Cisco N9000 and Cisco 8000 data center systems expected to go on sale in the second half of 2026.

According to Reuters, the chip addresses a critical challenge in AI infrastructure: as training and inference workloads scale to involve tens of thousands or even hundreds of thousands of GPU connections, data movement between processors becomes as important as the raw computing power of the processors themselves.

Martin Lund, Executive Vice President of Cisco’s Common Hardware Group, told Reuters that the G300 incorporates “shock absorber” features designed to prevent networks from bogging down when hit with large spikes of data traffic—a common occurrence in AI workloads. “This happens when you have tens of thousands, hundreds of thousands of connections – it happens quite regularly,” Lund explained. “We focus on the total end-to-end efficiency of the network.”

Key Specifications and Performance Claims

The Cisco Silicon One G300 AI networking chip 2026 delivers impressive specifications targeting the most demanding AI infrastructure deployments:

- 102.4 Tbps Switching Capacity: More than double the throughput of previous generations, enabling the chip to handle massive data flows in gigawatt-scale AI clusters used for training large language models, running inference at scale, and supporting real-time agentic AI workloads.

- 28% Performance Improvement: Cisco claims the G300 can help some AI computing jobs complete 28% faster compared to non-optimized networking. This improvement comes not from faster processors but from reducing communication delays and preventing bottlenecks that cause expensive GPUs to sit idle waiting for data.

- 3-Nanometer Process Technology: Built using Taiwan Semiconductor Manufacturing Company’s (TSMC) advanced 3nm chipmaking process, the G300 represents cutting-edge semiconductor manufacturing technology, delivering higher performance while consuming less power than chips built with older processes.

- Advanced Traffic Management: The chip includes sophisticated features for handling “bursty” AI traffic patterns. Unlike traditional enterprise data traffic that tends to be relatively predictable, AI workloads create sudden, intense bursts of data that can overwhelm conventional network systems. The G300’s intelligent load balancing and packet buffering prevent these bursts from creating bottlenecks.

- Programmability: Unlike fixed-function networking chips, the G300 is highly programmable, allowing equipment to be upgraded with new network functionality even after deployment. This protects long-term infrastructure investments as new AI use cases and networking requirements emerge.

Cisco’s Full-Stack AI Networking Approach

The Cisco Silicon One G300 doesn’t operate in isolation. Cisco is positioning it as part of a complete AI networking stack that includes silicon, systems, optics, and management software.

- New N9000 and 8000 Systems: The G300 will power next-generation Cisco Nexus 9000 and Cisco 8000 switches offering 102.4 Tbps switching speeds. These systems are designed for diverse customers including hyperscalers like Amazon Web Services, Microsoft Azure, and Google Cloud, as well as neoclouds, sovereign cloud operators, service providers, and large enterprises.

- Liquid Cooling Innovation: According to SiliconANGLE, the new systems are available in both air-cooled and 100% liquid-cooled designs. The liquid-cooled configurations, combined with new high-density optics, enable customers to improve energy efficiency by nearly 70% compared to previous generations—a critical advantage as data center power consumption becomes an increasingly serious constraint on AI infrastructure growth.

- High-Density Optics: Cisco introduced new 1.6T OSFP modules and 800G linear pluggable optics designed to reduce power consumption while supporting the massive data throughput required by next-generation AI scale-out networks. These optical components work in concert with the G300 silicon to maximize overall system efficiency.

- Nexus One Management Platform: Interesting Engineering reports that Cisco has enhanced its Nexus One management platform to deliver a unified control plane tying together silicon, systems, optics, and software across on-premises and cloud environments. This allows customers to stand up AI networking fabrics faster, scale predictably, and operate securely and efficiently.

How the G300 Competes with Nvidia and Broadcom

The launch of the Cisco Silicon One G300 AI networking chip 2026 intensifies competition in a market segment that has become increasingly strategic as AI infrastructure spending accelerates.

- Nvidia’s Integrated Approach: When Nvidia unveiled its latest AI systems in January 2026, networking was a central component. One of the six key chips in Nvidia’s system was a networking chip that competes directly with Cisco’s offerings. Nvidia’s strategy integrates networking functions with its AI accelerators, giving it control over the entire data path from GPU to GPU.

- Broadcom’s Tomahawk Series: Broadcom has established itself as a major player in data center networking with its Tomahawk series of Ethernet switching chips. These chips are widely deployed in hyperscale data centers and compete directly with Cisco’s Silicon One portfolio. Broadcom’s emphasis on merchant silicon—chips sold to multiple customers who build their own systems—differs from Cisco’s approach of integrating silicon into complete networking systems.

- Cisco’s Differentiation: Cisco brings advantages from its decades of networking expertise and existing customer relationships. Many enterprises already run Cisco networks and prefer to extend their existing infrastructure rather than introduce new vendors. According to World Wide Technology VP Neil Anderson: “WWT clients know and trust Cisco networking in the AI data center. With the G300-powered N9000 and Nexus One, we’re extending that trust to AI workloads.”

The $600 Billion AI Infrastructure Market

The competitive intensity around the Cisco Silicon One G300 AI networking chip 2026 reflects the enormous market opportunity in AI infrastructure. Industry analysts project AI infrastructure spending will reach approximately $600 billion in 2026 as companies across all sectors invest in capabilities to train models, run inference workloads, and deploy AI-powered applications.

This spending encompasses:

- GPU and AI Accelerator Hardware: The chips that actually perform AI calculations, dominated by Nvidia but with growing competition from AMD, Intel, and specialized AI chip startups

- Networking Infrastructure: Switches, routers, and optical components that connect AI processors—the market Cisco is targeting with the G300

- Storage Systems: High-performance storage required to feed massive datasets to AI training and inference workloads

- Power and Cooling Infrastructure: The electrical and thermal management systems needed to support power-hungry AI hardware

- Data Center Construction: Physical facilities designed specifically for AI workloads with appropriate power, cooling, and network connectivity

Networking has emerged as a particularly strategic segment because data movement bottlenecks can render expensive GPU investments ineffective. As Kevin Wolterweber, Cisco’s Senior Vice President and General Manager of AI Infrastructure, told SiliconANGLE: “The last two or three years, we’ve mainly been focused on building out massive training clusters with hyperscalers. Now you’re going to see enterprises, neocloud providers, and sovereign cloud operators increasingly investing in their own AI clusters.”

Impact on GPU Utilization and Efficiency

One of the Cisco Silicon One G300’s most significant value propositions is improving GPU utilization—ensuring that expensive AI accelerators spend their time computing rather than waiting for data.

Modern AI training runs distribute work across thousands of GPUs working in parallel. When one GPU needs data from another, the network delivers it. If the network creates delays or bottlenecks, GPUs sit idle waiting for information they need to continue processing. Given that cutting-edge AI accelerators can cost $30,000 to $50,000 each, idle time represents wasted investment.

Cisco claims the G300’s intelligent networking features—including the largest on-chip buffer in the industry, path-based load balancing, and real-time telemetry—can improve GPU utilization significantly. The company’s internal testing suggests a 28% improvement in job completion time and 33% higher network utilization compared to non-optimized networking paths.

For enterprises and cloud providers operating AI clusters worth tens or hundreds of millions of dollars, even modest improvements in GPU utilization translate to substantial financial benefits. A 28% faster job completion could mean training a model in 3.6 days instead of 5 days, or serving 28% more inference requests with the same hardware investment.

Agentic AI and the Future of Network Security

SiliconANGLE reports that Cisco’s Kevin Wolterweber emphasized how the growth of agentic AI workflows will drive major changes in how networks are secured and monitored. As AI agents become more autonomous and operate continuously across enterprise systems, network security must evolve beyond traditional centralized firewalls.

“We expect to see a lot more utilization of the network itself, because now you’re going to have a multiplicative effect of agents doing things for you,” Wolterweber explained. This means enterprises will need to manage identities and permissions for potentially thousands of autonomous agents, each requiring appropriate network access and security controls.

Cisco is responding by embedding security technologies directly into the G300 silicon, allowing policy enforcement to occur at network speed without creating performance bottlenecks. Rather than routing all traffic through centralized security appliances that can become chokepoints, security decisions happen distributed across the network infrastructure.

This approach aligns with the broader industry shift toward zero-trust networking, where every connection is verified regardless of source, and security is embedded throughout infrastructure rather than concentrated at network perimeters.

Liquid Cooling: Addressing the Energy Challenge

The availability of 100% liquid-cooled configurations for G300-powered systems addresses one of the most pressing challenges in AI infrastructure: energy consumption and cooling.

According to Cisco’s official announcement, the liquid-cooled designs, combined with new high-density optics, enable nearly 70% better energy efficiency compared to previous generations. This improvement comes from multiple factors:

- Direct Liquid Cooling Efficiency: Liquid cooling transfers heat more efficiently than air cooling, allowing components to operate at higher densities while consuming less energy for thermal management.

- Reduced Facility Load: More efficient cooling at the chip and system level reduces the load on data center HVAC systems, which can account for 30-40% of total facility energy consumption.

- Higher-Density Deployment: Liquid cooling allows more computing power to be packed into smaller spaces, reducing the data center footprint required for equivalent AI capability.

As AI infrastructure scales, energy has become a critical constraint. Some of the largest AI training clusters consume megawatts or even approach gigawatt-scale power requirements. Data center operators in many regions struggle to secure sufficient electrical capacity for planned AI expansions. Technologies like Cisco’s liquid cooling help extract more AI performance from available power budgets.

Enterprise and Sovereign Cloud Implications

While hyperscale cloud providers have dominated early AI infrastructure buildouts, the Cisco Silicon One G300 AI networking chip 2026 targets an expanding market of enterprises and sovereign cloud operators building their own AI capabilities.

- Enterprise AI Clusters: Large corporations in industries like finance, pharmaceuticals, energy, and manufacturing are increasingly investing in on-premises AI infrastructure rather than relying solely on public clouds. Motivations include data sovereignty concerns, compliance requirements, cost considerations at scale, and desire for control over AI capabilities.

- Sovereign Clouds: Governments and national telecom operators are building AI infrastructure within their borders to maintain digital sovereignty and reduce dependence on foreign cloud providers. Europe’s recent NanoIC pilot line and similar initiatives reflect this trend. Sovereign cloud operators need networking infrastructure from vendors they trust to meet security and policy requirements.

- Neocloud Providers: A new category of specialized cloud providers focused on AI workloads has emerged. These “neoclouds” often target specific industries or use cases, offering specialized AI infrastructure optimized for particular applications. They need flexible, efficient networking that can adapt as AI technology evolves.

For these customers, Cisco offers advantages beyond raw specifications. The company’s global support infrastructure, integration with existing enterprise networks, and decades of experience managing complex network deployments reduce risk compared to newer entrants or solutions requiring complete infrastructure replacement.

Market Analyst Perspectives

Industry analysts are watching the AI networking battle closely. Seeking Alpha notes that Cisco’s G300 positioning as a direct competitor to Broadcom and Nvidia’s latest networking chips could increase Cisco’s appeal in the AI infrastructure market, potentially driving revenue growth in a segment that has seen explosive expansion.

However, Cisco faces challenges. Nvidia’s integrated approach—controlling both the GPUs doing AI calculations and the networking connecting them—gives it advantages in optimization and total solution selling. Domain-b.com points out that vendors who master high-speed networking for AI stand to gain significant market share as infrastructure spending accelerates.

The fact that Cisco is innovating across the full stack—silicon, systems, optics, management software—demonstrates its seriousness about the AI networking opportunity. The company is not simply buying merchant silicon from others and repackaging it, but designing custom chips optimized for AI workload characteristics.

Timeline and Availability

The Cisco Silicon One G300 AI networking chip 2026 and powered systems are expected to become available to customers in the second half of 2026. This timeline puts Cisco on a competitive footing with Nvidia and Broadcom product cycles, ensuring customers evaluating AI networking options in 2026 will have Cisco solutions available.

Cisco has indicated that many announced features and capabilities will be finalized throughout 2026, with a staged rollout as products complete development and testing. This approach is common in enterprise infrastructure, where reliability and stability are paramount.

Early customer feedback from partners like World Wide Technology has been positive, with emphasis on how quickly Cisco has moved to address AI networking requirements. “This is the fastest we’ve seen Cisco move, and it’s exactly what our clients need to accelerate their AI journeys,” said WWT’s Neil Anderson.

What This Means for Tech Enthusiasts and IT Professionals

For technology professionals and enthusiasts, the Cisco Silicon One G300 AI networking chip 2026 signals several important trends:

- Networking Becomes AI-Critical: As AI infrastructure scales, networking performance directly impacts AI application performance. Skills in high-speed networking, particularly for AI workloads, will be increasingly valuable.

- Liquid Cooling Goes Mainstream: The shift toward liquid cooling in data centers creates opportunities for professionals with expertise in thermal management, facilities engineering, and advanced cooling technologies.

- Vendor Competition Benefits Customers: The three-way competition between Cisco, Nvidia, and Broadcom for AI networking market share should drive innovation and potentially moderate prices as each vendor works to differentiate its offerings.

- Security Architecture Evolution: The integration of security directly into networking silicon reflects how security must evolve to support agentic AI without creating performance bottlenecks. Security professionals need to understand these architectural changes.

- Open vs. Integrated Approaches: Cisco’s strategy of interoperating with GPUs from multiple vendors contrasts with Nvidia’s vertically integrated approach. Customers will choose based on whether they prefer best-of-breed components or optimized total solutions.

Conclusion: Cisco’s Bid for AI Networking Leadership

The Cisco Silicon One G300 AI networking chip 2026 represents Cisco’s most ambitious effort to establish leadership in AI infrastructure. With 102.4 Tbps switching capacity, 28% performance improvements, advanced liquid cooling, and integrated security, the G300 addresses the full spectrum of challenges facing organizations building large-scale AI infrastructure.

Cisco’s competition with Nvidia and Broadcom will benefit the broader AI ecosystem by driving innovation, improving efficiency, and potentially reducing costs as vendors compete for market share. The fact that a company with Cisco’s networking heritage and customer relationships is making such substantial investments in AI-specific infrastructure validates the strategic importance of this market segment.

For enterprises, cloud providers, and government organizations building AI capabilities, the G300 offers an alternative to Nvidia’s integrated approach and Broadcom’s merchant silicon model. Whether Cisco can successfully challenge these entrenched competitors remains to be seen, but the company’s full-stack innovation and existing customer relationships give it credible competitive positioning.

As we progress through 2026 and the second half of the year brings G300-powered systems to market, the AI networking battle will intensify. The winners will be organizations building AI infrastructure who benefit from improved performance, efficiency, and potentially lower costs as Cisco, Nvidia, and Broadcom compete for their business.

The $600 billion AI infrastructure boom is just beginning, and networking has emerged as one of its most strategic battlegrounds. With the Silicon One G300, Cisco has entered the fight.

Read more internal links here.

Leave a Reply